Long Call Calendar Spread

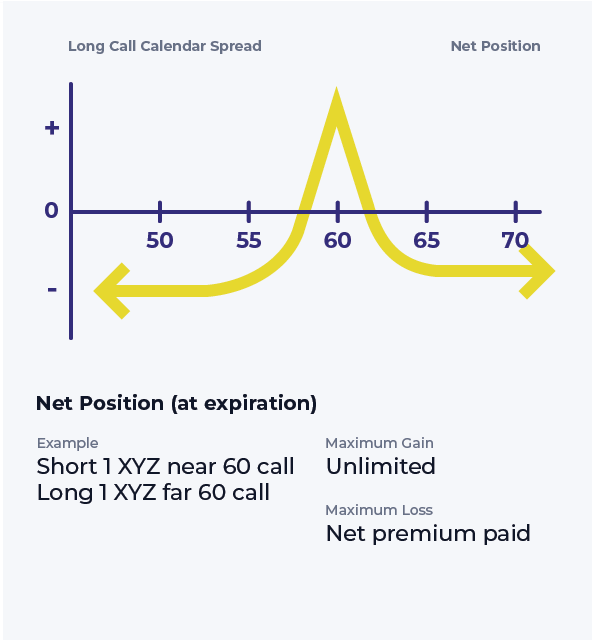

Long Call Calendar Spread - Web about long call calendar spreads. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. A calendar spread involves buying and selling the same type of option (calls. Use the optionscout profit calculator to visualize your trading. The net delta of a long calendar spread with calls is usually close to zero, but, as. Web long calls have positive deltas, and short calls have negative deltas. Select option contracts to view profit estimates.

Long Call Calendar Spread Printable Calendar

Use the optionscout profit calculator to visualize your trading. Web long calls have positive deltas, and short calls have negative deltas. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. A calendar spread involves buying and selling the same type of option (calls. Web about long call.

Long Call Calendar Spread Options Strategy

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web about long call calendar spreads. The net delta of a long calendar spread with calls is usually close to zero, but, as. Web a long calendar spread—often referred to as a time.

Long Call Calendar Long call calendar Spread Calendar Spread YouTube

Web about long call calendar spreads. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. The net delta of a long calendar spread with calls is usually close to zero, but, as. Web a long calendar spread—often referred to as a time.

Long Calendar Spreads Unofficed

Use the optionscout profit calculator to visualize your trading. A calendar spread involves buying and selling the same type of option (calls. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web about long call calendar spreads. The net delta of a long calendar spread with calls.

Long Call Calendar Spread Printable Calendar

Use the optionscout profit calculator to visualize your trading. Select option contracts to view profit estimates. The net delta of a long calendar spread with calls is usually close to zero, but, as. A calendar spread involves buying and selling the same type of option (calls. Web a long calendar spread—often referred to as a time spread—is the buying and.

How to Trade Options Calendar Spreads (Visuals and Examples)

Use the optionscout profit calculator to visualize your trading. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. The net delta of a long calendar spread with calls is usually close to zero, but, as. Select option contracts to view profit estimates..

How to Trade Options Calendar Spreads (Visuals and Examples)

A calendar spread involves buying and selling the same type of option (calls. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Select option contracts to view profit estimates. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price.

Long Call Calendar Spread Explained (Options Trading Strategies For Beginners) YouTube

The net delta of a long calendar spread with calls is usually close to zero, but, as. A calendar spread involves buying and selling the same type of option (calls. Web about long call calendar spreads. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web long.

Long Call Calendar Spread Printable Calendar

Use the optionscout profit calculator to visualize your trading. The net delta of a long calendar spread with calls is usually close to zero, but, as. Web about long call calendar spreads. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. A calendar spread involves buying and selling the same type of option (calls. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one.

Web long calls have positive deltas, and short calls have negative deltas. Select option contracts to view profit estimates. A calendar spread involves buying and selling the same type of option (calls. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Use the optionscout profit calculator to visualize your trading. Web about long call calendar spreads. The net delta of a long calendar spread with calls is usually close to zero, but, as. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying.

A Calendar Spread Involves Buying And Selling The Same Type Of Option (Calls.

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. The net delta of a long calendar spread with calls is usually close to zero, but, as. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Select option contracts to view profit estimates.

Web Long Calls Have Positive Deltas, And Short Calls Have Negative Deltas.

Web about long call calendar spreads. Use the optionscout profit calculator to visualize your trading.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)